Neobank vs traditional bank sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail. In an evolving financial landscape, neobanks are emerging as innovative alternatives to traditional banks, relying on technology and accessibility to attract a modern customer base. This exploration will delve into the features, services, and advantages offered by these digital-first banking solutions, drawing a clear comparison with their conventional counterparts.

Understanding the distinct differences between neobanks and traditional banks can empower consumers to make informed financial decisions. With a focus on user experience and modern technology, neobanks are reshaping the way individuals manage their finances, providing tools and services that cater to contemporary needs.

Neobanks Overview

Neobanks represent a new wave in the banking industry, bringing a refreshing approach to financial services. Primarily operating online without any physical branches, these digital banks leverage technology to provide a seamless banking experience. Their rise is attributed to their ability to cater to the needs of tech-savvy users looking for convenience, lower fees, and innovative features.Neobanks distinguish themselves from traditional banks through their unique offerings and customer-centric design.

Unlike conventional banks, which often rely on brick-and-mortar locations, neobanks provide services entirely through mobile apps and websites, enabling customers to manage their finances anytime and anywhere. This accessibility significantly enhances the user experience, allowing for faster account setup, real-time notifications, and an intuitive interface that many users find more appealing than traditional banking applications.

Technology Behind Neobanks

The technological framework of neobanks sets them apart from traditional banking institutions. Neobanks typically utilize cloud-based solutions, enabling them to scale quickly and adapt to changing market needs. This technology allows for automation of various banking processes, resulting in reduced operational costs and enhanced efficiency. Key aspects of the technology underpinning neobanks include:

- API Integration: Neobanks heavily rely on Application Programming Interfaces (APIs) to connect with third-party services. This integration allows them to offer a wide range of functionalities, from budgeting tools to investment options, all within a single platform.

- Data Analytics: By employing advanced analytics and machine learning, neobanks can personalize services based on customer behavior. This capability enhances user engagement and helps in offering customized financial products.

- Enhanced Security: Utilizing biometric authentication and advanced encryption technologies, neobanks provide robust security measures to protect user data and transactions, often exceeding the standards set by traditional banks.

- Agility and Innovation: Neobanks are built on modern tech stacks that allow for rapid deployment of new features and services. This agility enables them to respond swiftly to market demands and continuously enhance user experience.

In contrast, traditional banks often rely on legacy systems that can be cumbersome and slow to adapt. This can lead to longer wait times for service updates and less flexibility in responding to customer needs. As a result, neobanks often create a more dynamic and responsive banking environment, making them appealing to a growing segment of the population looking for modern banking solutions.

Financial Services Offered

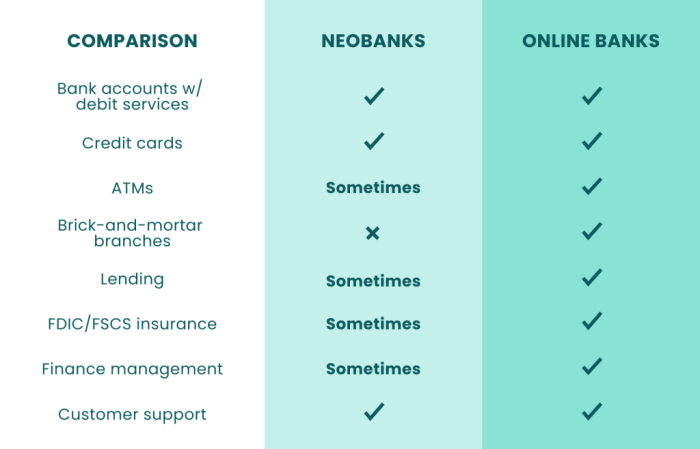

Neobanks and traditional banks both offer a variety of financial services, but their approach and range can differ significantly. Understanding these differences can help consumers make informed choices about where to manage their money. Neobanks, often described as digital-only banks, provide a suite of financial services that cater to the needs of a tech-savvy audience. Traditional banks, on the other hand, have a more established presence and offer a wider array of services that include physical branches.

Below is a comparative analysis of the financial services offered by both types of institutions.

Comparison of Key Services

The following table highlights the essential financial services provided by neobanks compared to traditional banks. This comparison serves to illustrate the strengths and weaknesses of each option.

| Service | Neobanks | Traditional Banks |

|---|---|---|

| Savings Accounts | Higher interest rates, no maintenance fees | Variable interest rates, may have fees |

| Checking Accounts | No minimum balance requirements, easy mobile access | Physical branches, overdraft protection options |

| Loans | Quick application processes, often limited options | Variety of loan products, extensive application support |

| Budgeting Tools | Integrated features with app, real-time tracking | Basic tools, may require additional financial products |

| Investment Services | Some offer basic investment features | Comprehensive investment services and advice |

Customer support services are crucial for any banking experience, and there are notable differences between neobanks and traditional banks in this area.

Customer Support Services

Neobanks typically emphasize digital support channels, allowing customers to access help via chatbots, in-app messaging, and email. This can lead to faster response times but may lack the personal touch that some customers prefer. Traditional banks generally provide a mix of digital and in-person support, with many offering phone support and face-to-face consultations at branches.

“The choice between neobanks and traditional banks often comes down to personal preferences regarding service delivery.”

As more customers seek convenience and efficiency, the customer service models of neobanks are evolving continuously, leveraging technology to enhance user experience. However, traditional banks continue to cater to clients who value personal relationships and comprehensive service options. This ongoing balance shapes the financial landscape for consumers today.

Impact on Personal Finance

Neobanks are revolutionizing the way individuals manage their personal finances. By leveraging technology and innovative features, they offer a fresh approach to budgeting, spending tracking, and financial planning. This shift allows users to take more control over their financial lives, often with greater ease and efficiency compared to traditional banking methods.The advantages of using neobanks for personal finance management are numerous.

They typically provide a user-friendly interface and real-time data analysis, enabling consumers to make informed decisions about their finances. This section delves into the features that enhance budgeting and spending tracking, while also examining the implications of neobanks on financial planning and investment strategies.

Advantages and Features of Neobanks in Personal Finance Management

Neobanks offer a range of features that significantly enhance personal finance management. Their unique approach focuses on accessibility and user engagement, which can lead to more informed financial decisions.Key features include:

- Real-Time Notifications: Users receive instant alerts about transactions, helping them stay aware of their spending habits.

- Automated Budgeting Tools: Many neobanks provide built-in budgeting tools that categorize spending automatically, making it easier to track where money is going.

- Spending Insights: Analytics features provide personalized insights, such as monthly spending summaries and alerts when approaching budget limits.

- Goal Setting Features: Users can set financial goals (like saving for a vacation) and track progress, fostering motivation and accountability.

- Integration with Financial Apps: Neobanks often integrate seamlessly with other financial apps, allowing for a holistic view of one’s financial health.

- No Hidden Fees: Transparency regarding fees (or lack thereof) empowers users to manage their finances without the worry of unexpected charges.

The implications of using neobanks extend beyond merely tracking expenses; they can also influence long-term financial planning and investment strategies. Neobanks typically simplify various aspects of personal finance, enabling users to make informed investment decisions. For instance, some neobanks offer investment products directly within their platforms, allowing users to seamlessly transition from saving to investing. This integration encourages more individuals to engage with their finances actively.Additionally, the ease of access provided by neobanks can lead to better financial habits.

Users are more likely to evaluate their spending and savings regularly, which may enhance their overall financial literacy. Through their innovative features and user-centric designs, neobanks are not just redefining banking; they are also empowering users to take charge of their financial futures in a way that aligns with modern lifestyles.

Epilogue

In summary, the discussion around Neobank vs traditional bank reveals significant shifts in the banking sector, highlighting the benefits and challenges that neobanks present. As consumers increasingly seek convenience and innovative solutions in financial management, the role of neobanks continues to expand. Whether you favor the personalized touch of traditional banking or the streamlined services of neobanks, understanding these differences is crucial for optimizing your financial strategy.

Answers to Common Questions

What is a neobank?

A neobank is a digital-only bank that operates without physical branches, offering banking services primarily through mobile apps and websites.

Are neobanks insured?

Yes, most neobanks partner with traditional banks to provide FDIC insurance for deposits, ensuring customer funds are protected up to $250,000.

How do fees compare between neobanks and traditional banks?

Neobanks typically have lower fees and fewer charges compared to traditional banks, often offering free account maintenance and low or no ATM fees.

Can I get loans from neobanks?

Many neobanks are starting to offer loans, but their services may vary, so it’s important to check individual neobank offerings.

Are neobanks safe to use?

Yes, neobanks use advanced security measures like encryption and two-factor authentication to protect user data and transactions.